Web3 Neobanks: Beyond Payments, Towards On-Chain

1. From Infrastructure to Daily Life: The Evolution of Stablecoins

Originally, stablecoins were assets used primarily within exchanges, functioning like digital dollars. They served as a cash equivalent for shifting trading positions, moving assets, or transferring liquidity between chains, but their use in the real economy was limited.

However, their status and scope of use have recently shifted dramatically. The U.S. is discussing legislation like the 'GENIUS Act' to bring stablecoins into the regulatory fold. This signifies that stablecoins are evolving beyond simple virtual assets into digital currencies protected and regulated by law.

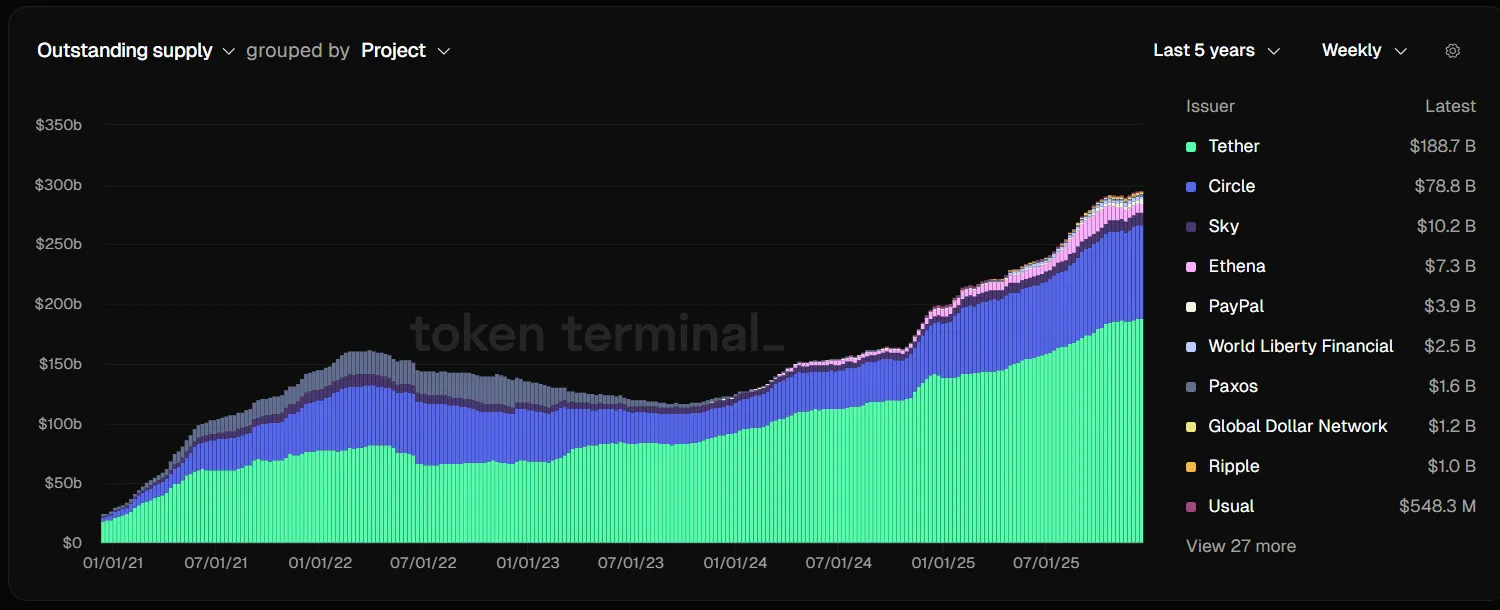

Source : Token terminal

Coupled with this institutional stability, the market size has exploded. The circulating supply of stablecoins, which stood at approximately $150 billion in 2022, has nearly doubled to approach $300 billion as of December 2025.

Stablecoins are no longer assets confined to exchanges and on-chain environments. As they expand into settlement and payment instruments in the real economy, the market’s focus has naturally shifted to the question: "How will mass adoption be achieved?"

Clues can be found in the moves of global fintech giants. Moving beyond the experimental phase, attempts to graft stablecoins onto existing financial infrastructure are accelerating. Visa has launched USDC settlement for institutions and plans to expand this by 2026, while PayPal’s PYUSD is being adopted as a settlement option for YouTube creators, creating real-world use cases. Recently, Stripe introduced 'Tempo,' a payment-specific chain, demonstrating a clear trend of stablecoins penetrating deep into the general user's payment experience.

However, the expansion of infrastructure does not automatically equate to mass adoption. Increasing stablecoin supply and building corporate settlement systems are merely foundational steps; for this to translate into actual usage, services in a familiar form are required. No matter how superior the technical infrastructure is, it is useless if it cannot integrate into the user's daily life.

The key point not to be overlooked is that users do not choose the payment rail. They choose the apps and intuitive financial interfaces they use every day. Factors such as payment convenience, reliable refunds, and customer support dictate adoption. Ultimately, the next battleground for stablecoins is not the infrastructure itself, but the competitiveness of the client-facing services that leverage it.

The model that bridges this gap is the Web3 Neobank. Web3 Neobanks utilize blockchain wallets as their infrastructure but provide users with the familiar experience of cards and bank accounts. Their core competitiveness lies in the abstraction of complexity. Users do not need to worry about which coins they hold; the system automatically handles swaps and settlements at the moment of payment. Consequently, the key to mass adoption lies in how organically these platforms can integrate financial functions—such as savings, lending, and asset management—on top of simple payments within the on-chain environment.

2. 'Neobanks': The App Linking Crypto and Finance

2-1. Cost Efficiency: A Structure Surpassing Traditional Banks

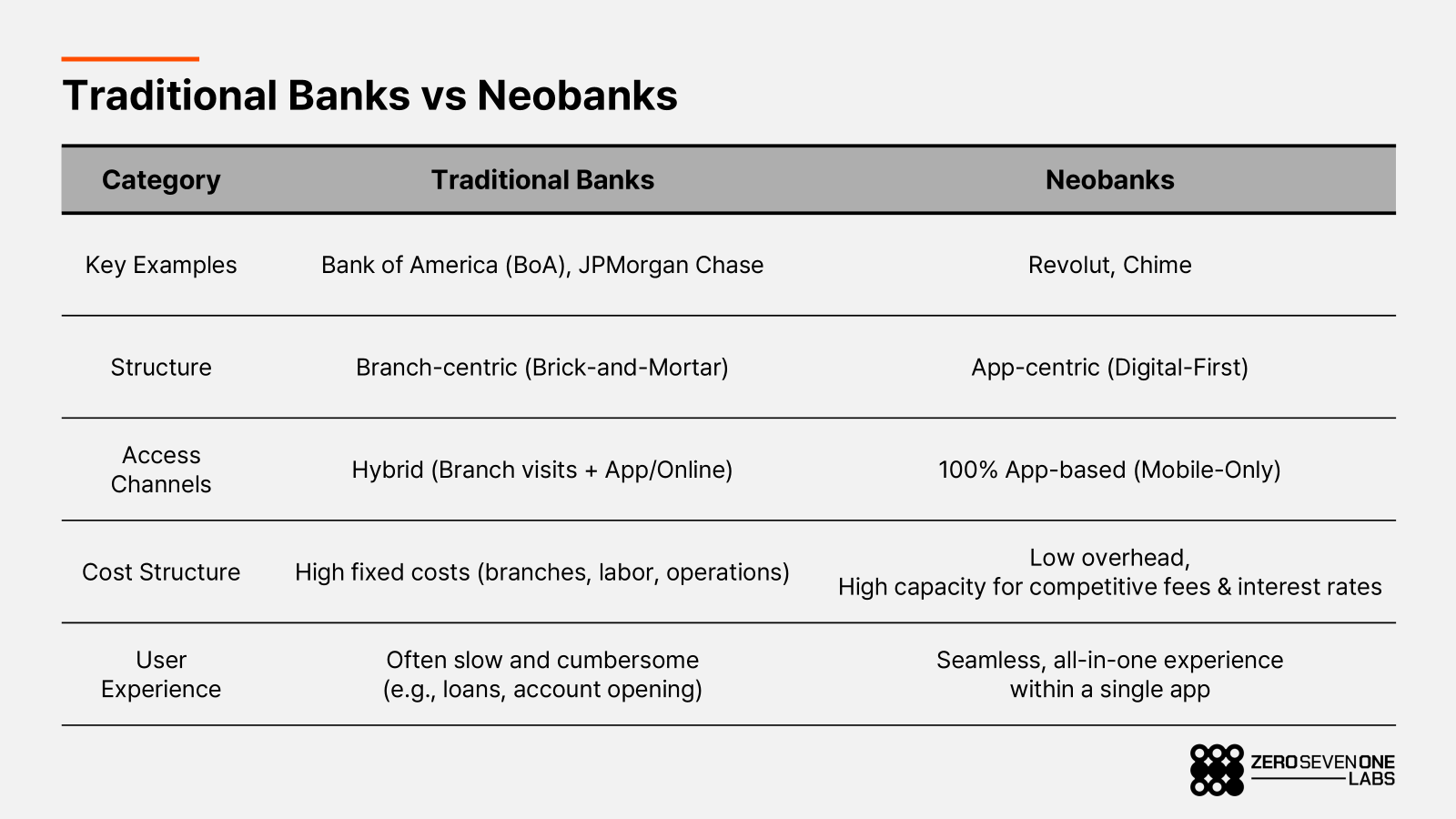

Neobanks are often described as "Internet Banks." They are "finance-specialized apps" provided online that bundle the entire process of storing, moving, paying, and managing money into a single application.

The reason Neobanks possess a competitive edge over traditional banks stems from their structure. Traditional banks, based on branches and face-to-face channels, bear high fixed costs such as labor, rent, operations, and legacy system maintenance. Naturally, their speed in launching products or improving systems is slow. In contrast, Neobanks operate primarily through digital channels without physical branches, resulting in relatively low fixed costs. This allows them to allocate more resources to product competitiveness (e.g., higher interest rates, lower FX spreads) and rapid product iteration.

This difference in cost structure leads directly to product competition. Based on these cost savings, Neobanks provide free transfers, low cross-border payment fees, aggressive rewards, and intuitive UX. As the user base grows, recurring financial flows like payments, FX, and transfers accumulate within the app, allowing the platform to expand into services like deposits, lending, and investments.

In short, the success formula of Neobanks is to secure product competitiveness through a low-cost structure, lock in users with fast service improvements, and then expand into diverse financial functions on that foundation.

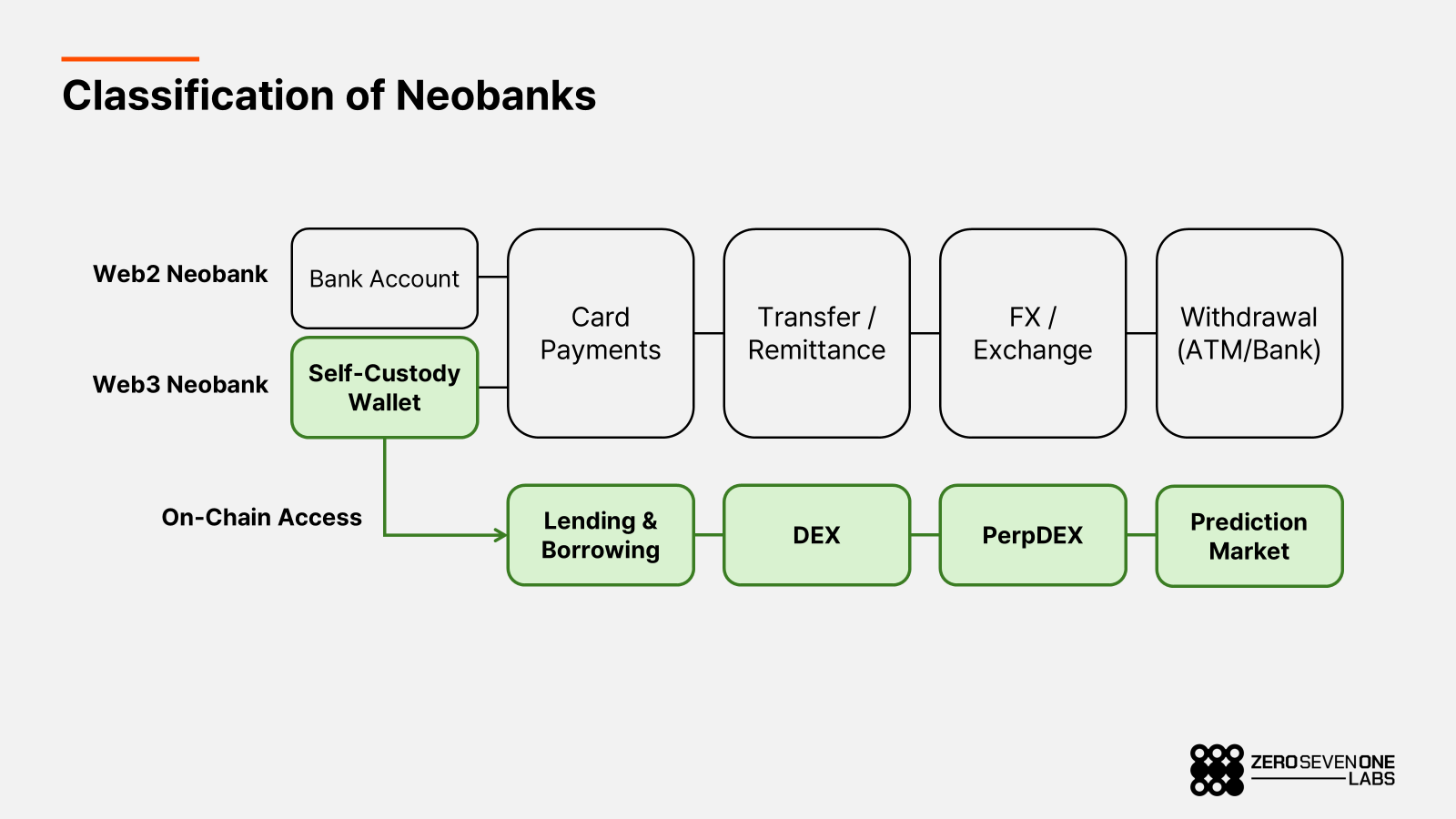

The mass adoption of stablecoins requires this exact approach. A medium is needed to translate stablecoins and on-chain assets into a financial experience familiar to users. Web3 Neobanks fulfill this role. They extend the user experience of existing Neobanks into the on-chain realm. By storing crypto assets in an in-app wallet and linking them directly to a payment card for daily consumption, they unify banking and on-chain activities into a single experience.

The crux here is that the wallet acts not just as storage, but as a financial account controlled directly by the user. While traditional banking apps are merely interfaces for viewing balances held by an institution, Web3 Neobanks construct flows for payments, transfers, and exchanges based on on-chain assets owned by the user. This is a Self-Custody structure where the user retains complete ownership and control without entrusting assets to a third party, embodying the philosophy of Web3 in a financial system.

Simultaneously, to ensure payment finality, the On/Off-ramp process is fully internalized within the app. Users naturally "on-ramp" assets via bank transfers or direct deposits and "off-ramp" via card payments or ATM withdrawals. Crucially, the complexity of interacting with exchanges (CEX) or bridges is removed. Technical barriers like swaps and settlements are automated in the backend, leaving the user with only a seamless financial experience.

2-2. The Integrated Experience: The Loop Connecting Payments and Investment

However, the value of Web3 Neobanks is not limited to simply paying with cryptocurrency. Their true potential lies in becoming a gateway that seamlessly connects the on-chain ecosystem with the user's daily life.

For example, consider embedded DeFi or PerpDEX features within the app. Users can participate in on-chain investments immediately without worrying about complex wallet signatures or transaction flows. Following investment activities, the resulting assets are instantly reflected in the wallet balance, which can then be used for offline card payments or transfers without any separate withdrawal process. A continuous loop of "Invest → Hold → Spend" is formed within a single wallet, the Neobank app.

This structure is powerful because it maximizes capital efficiency (liquidity). In traditional finance, tied-up investment capital and disposable cash are separated. In Web3 Neobanks, however, assets earning interest through lending or liquidity provision can be utilized for payments at any time. By blurring the boundary between asset management and consumption, it creates a state where your money is constantly working for you yet remains liquid enough to spend instantly.

Of course, current technology has not yet reached the level of full financial automation (e.g., via AI Agents). Currently, the focus is on reducing friction in the payment and asset conversion process. Real-time swaps at the moment of payment, optimal exchange rate application, and rule-based automatic rebalancing are prime examples. Yet, this change alone is significant. By fully abstracting complex on-chain execution processes in the backend, Neobanks enable users to enjoy the benefits of blockchain technology without needing to understand it at all.

3. Incentive Wars and Sustainability

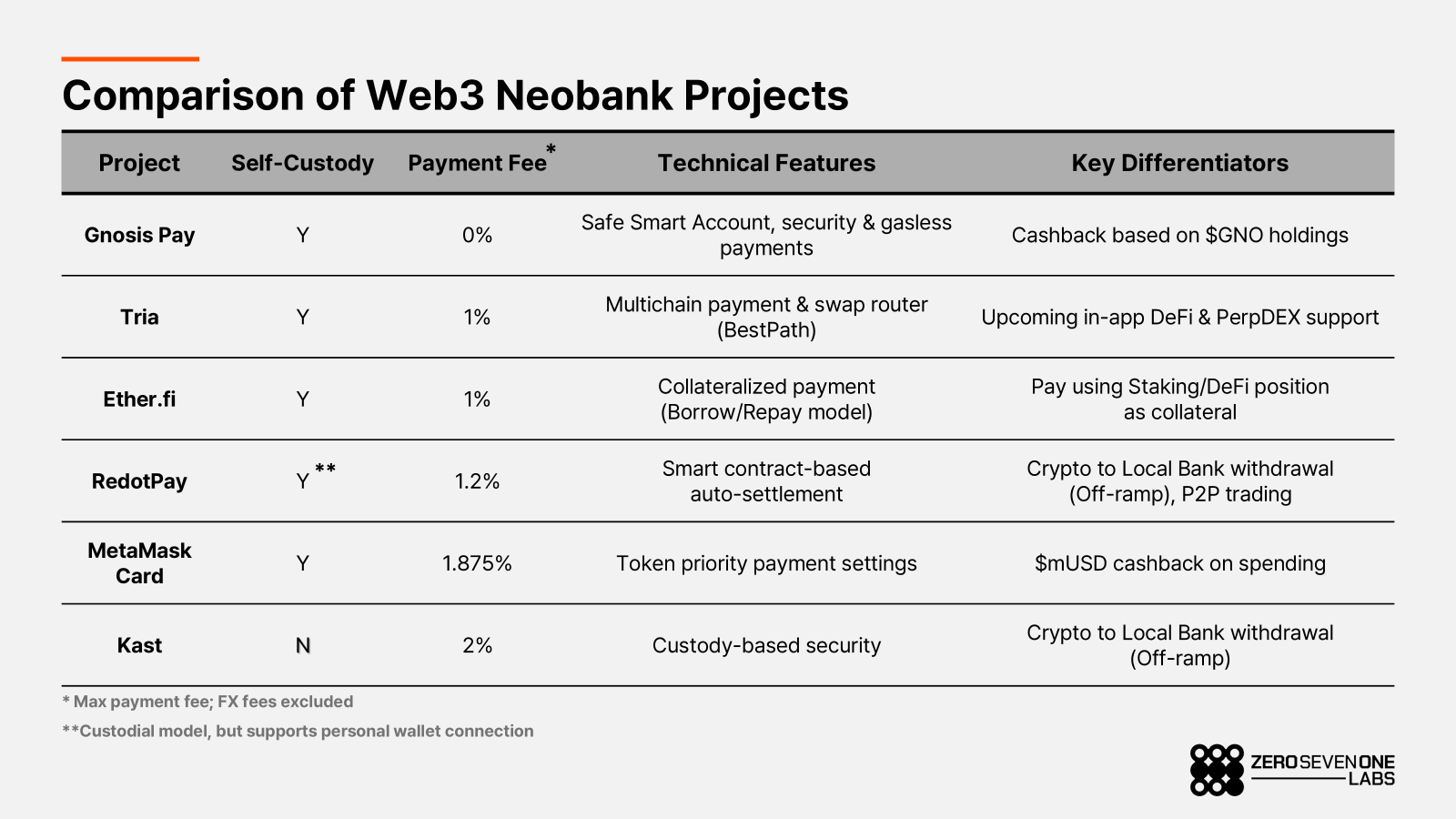

Currently, the number of projects identifying as Web3 Neobanks is growing rapidly. However, the current product form is mostly concentrated on card issuance and payment functions. At this stage, the perceived utility compared to Web2 Neobanks is not significant. That is, the mere fact that one can pay with crypto is a weak incentive for users to switch. For users, operational quality—such as low fees, refund policies, and customer support—is more important than the payment experience itself, which is already sufficient in Web2.

Ideally, the long-term differentiator lies in the "integrated on-chain experience" mentioned earlier. The problem is the time lag between this ideal and reality. Since most projects have not yet fully implemented these structural advantages, they cannot beat the overwhelming convenience of Web2 Fintechs with product differentiation alone. Consequently, projects at this stage have chosen financial incentives as a strategic weapon to bridge the gap in product utility and acquire early users. They are attempting to enter the market by paying for the user's switching costs through waived payment fees, cashback, and token rewards (points).

The current Web3 Neobank market is closer to a foundational stage of laying down a card-based payment network rather than building a comprehensive bank. In reality, offering crypto payments alone is not enough to make users switch cards. Thus, projects are forcing early habits by subsidizing users via incentives. It is a war of subsidies to seize market share rather than a competition of product power.

The issue is that these subsidies are not a sustainable moat. Compared to the optimized operational quality of Web2 Neobanks, there are still many gaps. Especially in specific markets like Korea, structural disadvantages such as cumbersome on/off-ramp processes, FX spreads, and the "Kimchi Premium" accumulate, making crypto payments feel like a loss. Ultimately, users may use the service solely for token rewards, risking the creation of "cherry-pickers" who will leave like a receding tide the moment rewards decrease.

This situation strangely resembles the "bleeding competition" of the past e-commerce market (e.g., the delivery wars in Korea). Companies like Coupang or Market Kurly survived head-to-head battles with retail giants not simply because of discount coupons, but because they built a moat around an irreplaceable experience: "Dawn Delivery" (Next-day delivery). Web3 Neobanks are the same. Currently, relying only on payment functions is akin to merely distributing discount coupons.

Therefore, the key to future survival lies in the conversion rate. The decisive factor is how quickly users attracted by subsidies can be anchored to the on-chain experience. Projects must lead users naturally from simple payments to high-yield, high-utility on-chain products like DeFi, RWA (Real World Assets), and PerpDEX. Ultimately, the success or failure of a Web3 Neobank depends on who can first evolve users who took the "payment bait" into genuine on-chain users.

4. Conclusion: The Moat of Web3 Neobanks is 'On-Chain Connection’

The big picture for Web3 Neobanks is, essentially, a "Financial Super App." Payment is the most powerful hook to make users open the app daily. Once a user is acquired, the platform naturally extends to transfers, FX, asset management, and investment. Just as Web2 Neobanks gathered users with easy transfers and then absorbed full banking services, Web3 Neobanks are using payments as a Trojan Horse to bundle users' financial behaviors and on-chain activities within their ecosystem.

Their greatest moat lies in the internalization of the On-ramp. Previously, using on-chain dApps required high-friction barriers: depositing to a CEX, buying stablecoins, and transferring to a private wallet. Web3 Neobanks absorb this entire process into a single app. Simply depositing funds grants access to on-chain products as if using a traditional banking app. As sectors like prediction markets and RWA tokenization increasingly move into the regulatory fold, Web3 Neobanks will secure a monopoly as the only compliant gateway to the on-chain world.

In this context, Ether.fi promotes "Cash out without selling" as its core value proposition. This method supports immediate payments based on the collateral value of held assets without requiring the user to unstake or sell. This goes beyond simple card payments; it builds a unique moat for an On-chain Neobank by allowing users to continue Asset Management (Yield) and Consumption without disconnection.

Tria is creating a similar flow through the integration of dApps. By embedding native PerpDEX or yield farming functions within the app, it provides an all-in-one experience where users can participate in on-chain financial products and generate revenue naturally within the payment app, without complex wallet connections.

The direction of this competition will ultimately lead to "Invisible Finance." While simply providing on-chain functions is a competitive edge today, future competition will become much more sophisticated with the combination of payment standards like x402 and AI Agents. In particular, asset management combined with AI signifies the realization of true "Programmable Money," where assets automatically find the most efficient path for deposits, yield farming, or lending based on the situation, going beyond simple automation. This sophisticated abstraction capability will be the key keyword determining the hegemony of next-generation Neobanks.

Of course, current Web3 Neobanks are unfinished. The on-ramp process is still cumbersome, and connections to dApps remain rudimentary. However, as long as attempts to bridge crypto, the real economy, and traditional finance continue, Web3 Neobanks will be the battlefield where the first true mass adoption occurs. This is why we must continue to pay close attention to the evolution of this market.

This article is provided for informational purposes and general market commentary only, and does not constitute investment advice or a solicitation to buy or sell any asset. The views expressed herein are those of the author(s) as of the date of writing and are subject to change based on market conditions. You are solely responsible for your investment decisions and outcomes; before investing, you should conduct your own research and, where appropriate, consult independent financial, tax, and legal advisors. The author(s) and/or 071labs may hold positions in the assets mentioned in this article and may have related interests. Past performance does not guarantee future results.