DEX Boom, Will Decentralized Exchanges Surpass CEXs?

1. The Growth of DEXs Lies in User Experience and Community

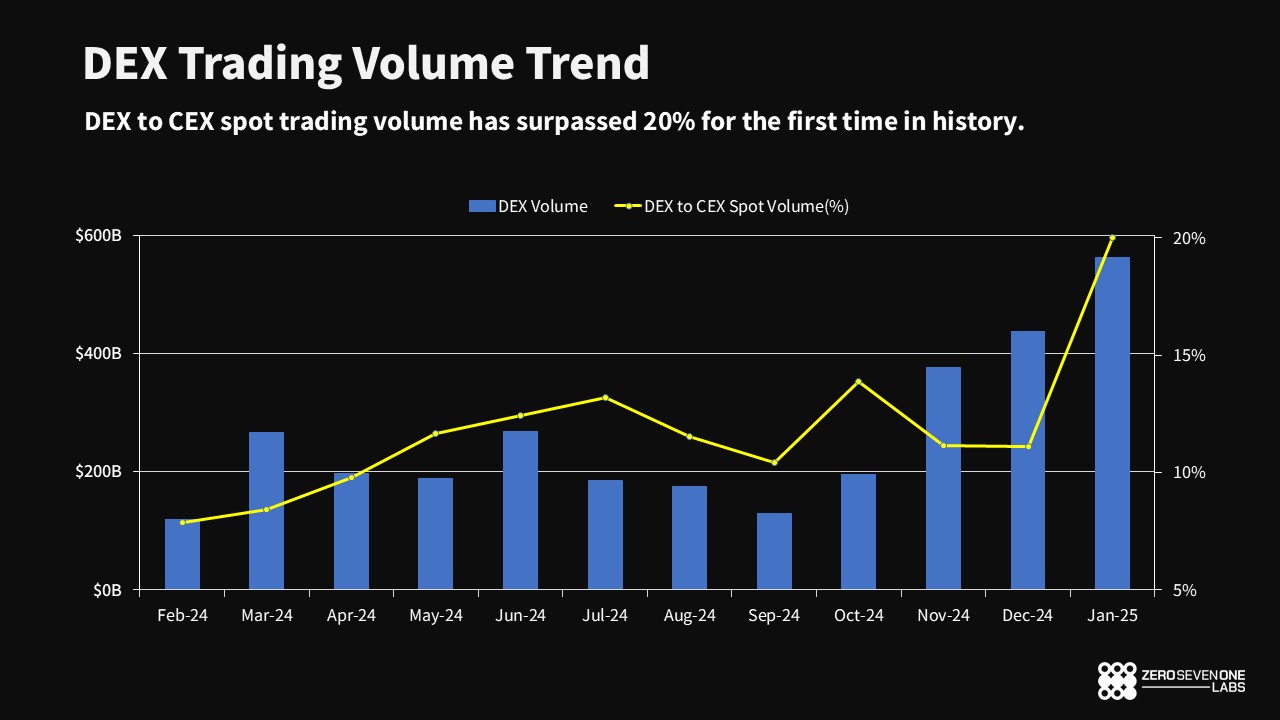

Last month, DEX trading volume reached a historic high, hitting around 20% of CEX volumes. DEXs have evolved far beyond simple swaps, rapidly advancing in multiple directions. The launch of Layer 2 solutions and Solana has addressed Ethereum’s core pain points of slow speed and high fees, while innovations in crypto wallets and trading bots/apps have created a much more seamless user experience. Recently, new DEXs like Hyperliquid and UniversalX have begun to deliver user experiences that rival centralized exchanges.

But the evolution of DEXs isn’t just about infrastructure upgrades or better UX. The spirit of Web3 and decentralization is fundamentally user- and community-centric. Meme coins and AI projects launched via fair-launch launchpads such as Pump.fun and Virtual Protocol have naturally built powerful, user-driven communities from day one. As the power of these communities translates directly to price action, DEXs have cemented themselves as both the starting point and the heartbeat of major Web3 trends.

2. CEXs Are Losing Their Edge

Apps and protocols focused on user experience and community have triggered a parabolic rise in DEX volumes, closing the gap with CEXs. Meanwhile, centralized exchanges are seeing a decline in user trust due to listing practices and regulatory headwinds.

2-1. Low Circulating Supply, High Listing Prices

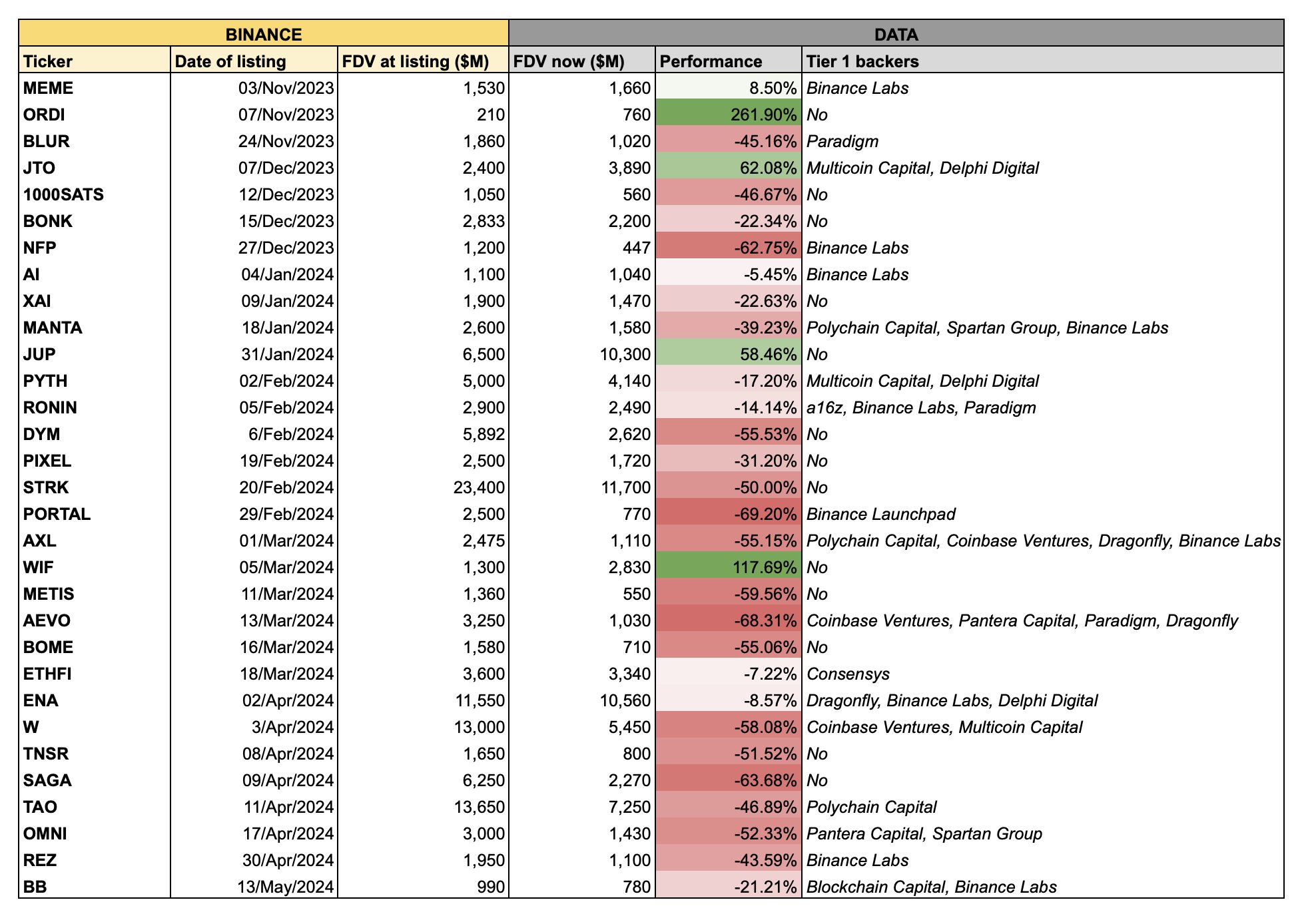

Many tokens listed on CEXs experience continual price decline post-listing, fueling suspicion among users that they are serving as the "exit liquidity" for early insiders. According to data summarized by @tradetheflow_, over 80% of tokens listed on Binance in the six months leading up to May 17, 2024, were trading below their initial listing price. Meme coins and tokens outside the Solana ecosystem have suffered particularly steep drops. While these downtrends may not be intentional on the part of CEXs or token foundations, the net effect is that users are increasingly skeptical about their prospects of turning a profit on CEX launches.

2-2. Opaque Listings and Insider Allegations

The listing process for tokens on CEXs is often shrouded in opacity, raising persistent concerns about insider trading. Exchange staff involved in listings may gain access to information ahead of the public, allowing them to accumulate tokens pre-announcement and dump them immediately after listings go live. This has led to instances where token prices sharply drop right after listing announcements, sparking major backlash from the community. Although CEXs deny any wrongdoing, many users remain unconvinced.

2-3. Regulatory Challenges

Beyond issues of trust and transparency, tightening regulation has become a critical factor eroding the competitiveness of CEXs.

For example, in 2017, Coinone launched margin trading only after extensive legal review but was forced to suspend the service due to concerns from regulators, pushing users to overseas CEXs. Similar patterns emerged elsewhere: China shut down major local CEXs in 2017 and fully banned crypto trading in 2021, causing user migration abroad. In Japan, the stringent and slow listing process makes it impossible to keep pace with fast-moving Web3 narratives; recently, all unauthorized overseas CEXs were removed from app stores, accelerating user migration to DEXs.

In short, the slow, conservative regulatory policies of many countries have left them unable to keep up with the pace of Web3 innovation. Users have migrated to alternatives with better user experience and fewer restrictions, causing DEX volumes to explode. Where users once fled to offshore CEXs, now they are opting into new onchain ecosystems.

3. Remaining Challenges for DEXs

While CEXs are losing ground, DEXs still face meaningful challenges in further scaling their competitiveness. Infrastructure and UX must continue to improve.

3-1. Liquidity Fragmentation Across Chains

With the wave of new Layer 1 mainnet launches, liquidity fragmentation is becoming more severe. Users are forced to bridge assets between chains and interact with multiple DEXs, resulting in inefficiencies and poor UX. To address this, DEXs need to advance cross-chain solutions that seamlessly aggregate liquidity and enable asset swaps across chains.

3-2. External Dependencies

Most DEXs are heavily reliant on specific chains and infrastructure. When networks become congested, users suffer from high gas fees, and transactions can be subject to MEV attacks, leading to unpredictable losses. Moreover, DEXs often lack dedicated interfaces for trending sectors like launchpads, meme coins, or AI trading, forcing users to pay extra for trading bots and third-party apps. This means users not only rely on external infrastructure for essential functions like MEV protection or bot trading, but also shoulder extra costs. Meanwhile, core contributors such as liquidity providers still earn only base fees and are not fully rewarded for their critical role.

3-3. Smart Contract Security

Because DEXs operate on public smart contracts, vulnerabilities can sometimes be exploited to drain funds from liquidity pools—as happened on February 13th with Four.meme.

Furthermore, the open nature of DEXs allows anyone to create liquidity pools, which can be a double-edged sword. Malicious actors sometimes deploy tokens with hidden code (e.g., honeypots, blacklists, freezes) that prevent sales and trap user funds. To protect users, there must be better detection and prevention of such malicious pools. DEX teams should also proactively bolster security to guard against future exploits.

4. The Move Onchain Will Only Accelerate

Since the early days, Web3’s unique product innovations have always driven DEX growth—first with DeFi and NFTs, now with meme coins and AI launchpads. This pattern is set to continue. As these exclusive Web3-native products emerge, alongside the ongoing evolution of onchain infrastructure, tightening global regulation, and the persistent problems of CEX centralization, the migration of users to onchain platforms will only accelerate.

As a result, DEX user numbers will surge and the gap with CEXs will continue to close.

This research was prepared independently by the author(s). The project team may provide fact-checking input or feedback; however, to preserve data accuracy and objectivity, 071labs retains final editorial and publication control. The author(s) and/or 071labs may hold the cryptocurrencies/tokens referenced in this research and may have direct or indirect interests in the project (including, but not limited to, investments, advisory roles, or compensation). This research is provided for informational purposes only and does not constitute investment advice. Before making any investment decision, you should conduct your own research and, where appropriate, consult independent financial, tax, and legal advisors. Past performance does not guarantee future results.

This article is provided for informational purposes and general market commentary only, and does not constitute investment advice or a solicitation to buy or sell any asset. The views expressed herein are those of the author(s) as of the date of writing and are subject to change based on market conditions. You are solely responsible for your investment decisions and outcomes; before investing, you should conduct your own research and, where appropriate, consult independent financial, tax, and legal advisors. The author(s) and/or 071labs may hold positions in the assets mentioned in this article and may have related interests. Past performance does not guarantee future results.